Did you know that divorce rates are increasing for people over 50? Sometimes called a “gray divorce” or “late-life divorce,” as people live longer, they can also grow apart. Especially as kids grow up and move out, couples can find themselves with incompatible life goals. Plus, as more and more women are more financially independent, there also is less of a financial imperative to stay together and more flexibility to leave. Lastly, there’s less stigma attached to ending a marriage and living single – even one that has lasted for decades.

However, there are many ways that divorce after 50 differs from one earlier in life. Much of the difference is financial, as the cost of living alone is much larger than splitting finances. This can shatter retirement plans, and there’s simply less time to recoup losses or pay off debt. In today’s blog post from The Law Office of Ronald Kossack, we’re providing a few common divorce mistakes that people over 50 make, and how to protect your financial future by avoiding them. Continue reading to learn more, and if you’re in need of a divorce lawyer in Tempe, contact our office today.

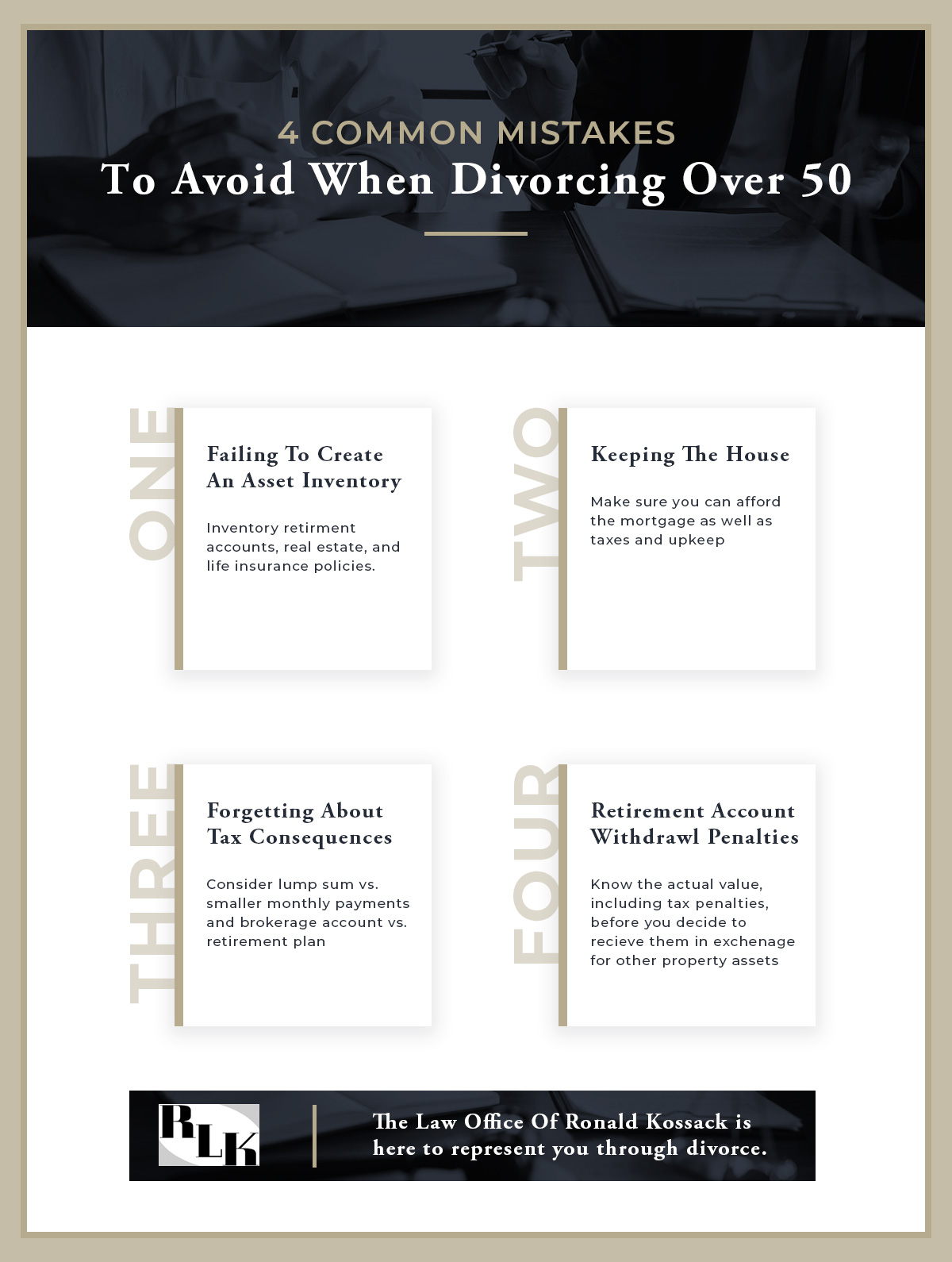

Failing To Create An Asset Inventory

It’s not uncommon for one partner to handle more of the finances than the other. When the couple decides to get divorced, this person is likely to have a better idea of how much money their investment accounts hold, the value of their assets, and even how much cash is in their savings accounts. The other partner is left to catch up and can be left without a full understanding of the assets before it is time to split them up. In addition to knowing what’s in your bank accounts, you should also track retirement accounts, real estate, and life insurance policies.

Keeping The House

If you end up with the family home, it’s important to think long and hard about whether it’s worth it to keep it. While you may have deep sentimental attachments to your home, it can also end up being a money pit, especially when there’s only one person paying for taxes and upkeep. Before you decide to stay, make sure that you can afford the mortgage as well as other costs associated with being a homeowner.

Health Insurance

If you’re between the ages of 50 and 65, you’ll need to find a way to cover your health insurance before you’re able to receive Medicare. If you have health insurance through your spouse’s job, you can extend that coverage through COBRA, but it’s likely going to be much more expensive than when you were married. If health insurance costs are going to break the bank, you can consider a legal separation so that you can keep your ex’s health insurance, but separate other assets.

Tax Consequences

Nearly every financial decision you make during the divorce process involves tax consequences, and you need to make the right choices for yourself. Consider the implications of a lump sum versus smaller monthly payments or accepting a brokerage account versus a retirement plan. Both you and your spouse should consult an accountant or tax advisor before making these decisions, as it will affect your retirement.

Retirement Accounts

Retirement funds can be one of the most significant assets a person over 50 owns. Often, these funds are penalized if they are withdrawn before retirement, and the value is based on maintaining the account. It’s important to know the actual value (including the tax penalty) before you decide to receive them in exchange for other property assets, such as property or savings accounts.

Consider Divorce Mediation

While we’ve primarily discussed the financial implications of divorce, divorce can cause immense emotional strain on everyone involved. You may benefit from divorce mediation prior to divorce, or to go to arbitration and counseling. These opinions are a private way to talk through what has brought you to considering divorce.

Divorce mediation is a less formal way to find common ground on property distribution, maintenance issues, as well as child custody and visitation. The Law Office of Ronald Kossack provides divorce mediation services and many couples find that it’s a less stressful, and more affordable, way to separate. If children are involved in the divorce, divorce mediation can be more child-centered and allows you to have more control over the outcome of the case. Our goal with divorce mediation is to help you find resolutions that meet your family’s needs and goals.

The Law Office of Ronald Kossack – Tempe Divorce Lawyer

We are proud to represent clients in Tempe and the surrounding area, including Phoenix, Mesa, Chandler, Gilbert, and Ahwatukee. If you’re looking for a divorce attorney or divorce mediation, we’d be more than happy to talk with you about your options and what we can do for you. We also focus on areas of paternity, child custody, decision-making, child support, and modifications to existing court orders. Schedule a free consultation today.